Who doesn’t want a smart, effective, and easy way to manage their money and achieve financial freedom? We all do, right?!

After searching the market and exploring various apps, Money Fellows emerges as the perfect solution for all of us! With flexible Money Circles (known as game’yat) offered by the app, you can join a circle with others and either start saving or receive a large amount that helps you achieve your goals.

In this article, we’ll provide you with a comprehensive guide explaining everything you need to know about Money Fellows, From the app's features and registration process to how to join circles and take advantage of the services it offers. Ready? Let’s dive in!

What is Money Fellows?

Money Fellows is the first and largest Money Circles (game’yat) app in Egypt, and the only one supervised by the Central Bank of Egypt’s Regulatory Sandbox with the company itself registered with the Ministry of Investment. Launched in 2018, Money Fellows provides secure and guaranteed online Money Circles, free from the risks of traditional circles.

The app integrates users into a well-organized system where each user signs a legal contract before joining any circle, ensuring the protection of their rights and the rights of other users.

Key Features of Money Fellows

Money Fellows offers a variety of features that make it an appealing choice for users. Here are some key benefits:

1- Financial Security and User Protection

- Money Fellows ensures the protection of users' personal and financial data. This means that all your information, including bank account details, national ID, and financial transactions, is securely stored, and only you have access to it.

- The app is licensed and regulated by relevant financial authorities, especially the Central Bank of Egypt. This guarantees that all transactions conducted through the app follow the highest security standards and financial laws.

- Each user is provided with a legal contract for the amount they contribute to the circle, and they sign it to secure their rights and the rights of others.

- Transparency is also a major feature. Every step in the app is fully transparent, allowing users to view all the details of their circles at any time and receive continuous updates on any developments.

2- Flexibility

- Each user can choose the amount they need, whether their goal is saving or receiving a large amount at a specific time to meet a certain financial objective. Additionally, users can participate in multiple circles at the same time.

- Users also have the flexibility to choose when to receive their payout, whether at the beginning, middle, or end of the circle. This gives them more freedom in managing their finances.

- The variety of circles, payout amounts, and timeframes allows users to find a circle that suits their needs.

3- Ease of Use

The app is designed with a simple and user-friendly interface that allows anyone, even those with no prior experience using financial apps, to navigate and use it with ease. Registering and joining circles is a straightforward process with clear, easy-to-follow steps.

4- Variety of Payment and Payout Methods

Money Fellows supports a wide range of payment and payout methods:

- Payment Methods: The app offers several payment options such as Fawry, bank transfers, Prepaid Cards, or e-wallets.

- Payout Methods: Users can receive their circle payouts via bank transfer, prepaid cards, or e-wallets.

5- Regular Notifications

Money Fellows sends regular notifications to its users, reminding them of payment and collection deadlines. This ensures that there are no delays in receiving or making payments.

How to Register on Money Fellows App?

1- The first step is to download the app, and you can do that through the following link: Download Money Fellows App

2- Once downloaded, tap the sign-up button and fill in the required details, such as your full name, email, phone number, and national ID.

3- You will receive a verification code (OTP) to confirm your account.

4- Provide your financial details, such as your bank account number or other payment information you'll use for the money circles.

5- A legal agreement for your circle contribution will be sent to you. Sign in to confirm your participation.

Once these steps are completed, you'll have successfully registered with Money Fellows, and you're ready to join Money Circles and benefit from the app's many features.

How to Join a Money Circle on Money Fellows?

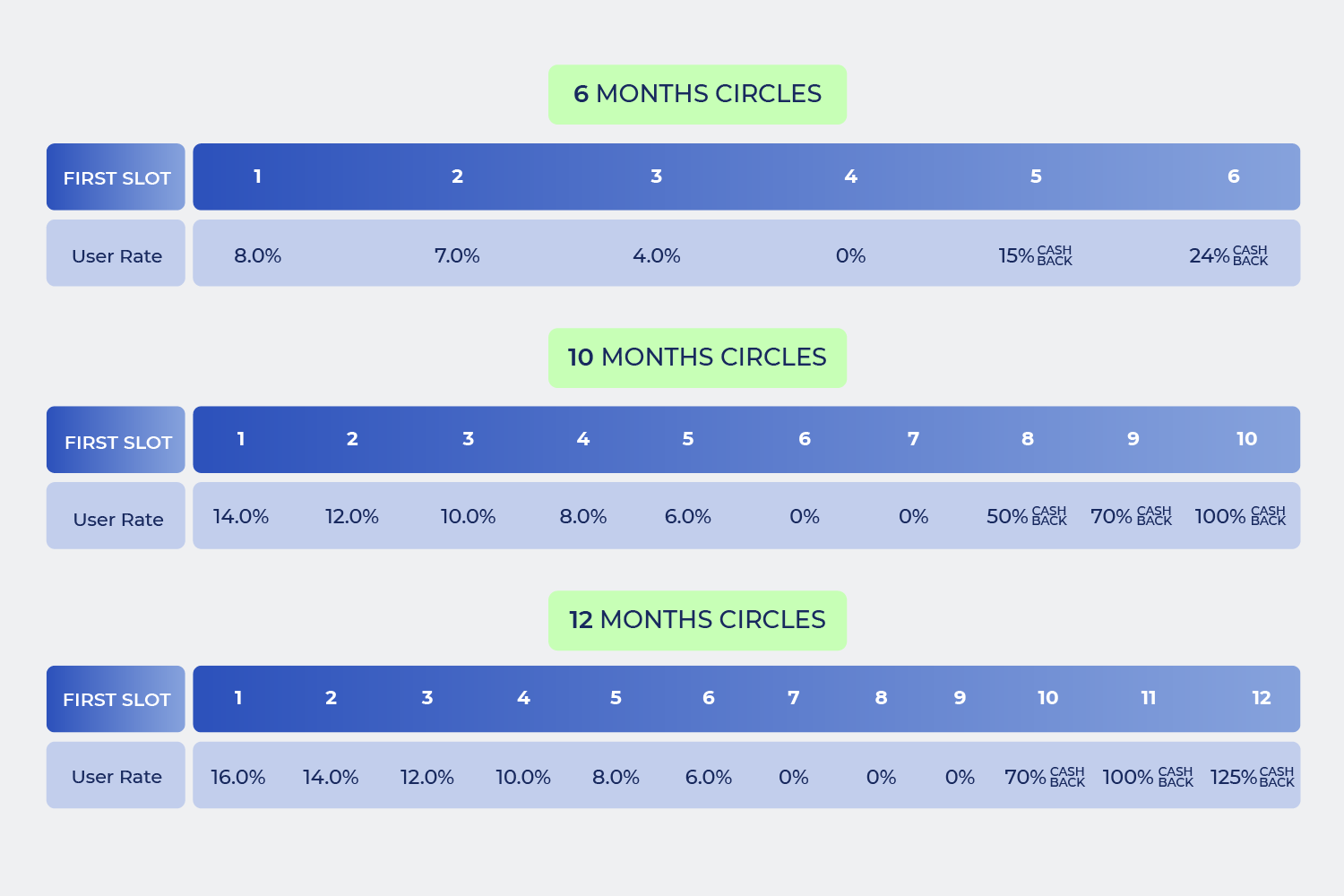

1- Log into the app and browse the available circles, reviewing important details like the monthly payment, circle duration (whether it’s 6, 10, or 12 months), and payout schedule.

2- Choose the money circle that suits your needs after reviewing the full details, including the payment schedule.

3- Click "Join" and add your payment details, such as your bank account or prepaid card.

4- Through the app, you can track your circle’s details, such as payment dates, your turn to receive the payout, and the alerts you’ll receive for payment and payout schedules.

Types of Money Circles & Saving Plans on Money Fellows

Money Fellows offers different types of money circles to meet various needs, providing users with opportunities to save and plan for their future in a structured and easy way. Whether you're looking to achieve a short-term goal or invest for the long term, you can find a circle that matches your financial needs.